Mortgage interest rates of seven percent! That seems high, doesn’t it? Interest rates are the…

Why You Should Buy A House at the Current Rate And Refinance Later

Mortgage interest rates are on the high side right now, but savvy buyers quickly discover some important reasons to buy a house at the current rate and refinance later!

Since late 2020, rates have gone up from the mid-twos to the low sixes. For homebuyers, a higher rate usually translates into higher monthly payments. That can affect overall affordability, and leads many potential buyers to put off their dreams. But it SHOULDN’T!

Here’s why: There are some surprising advantages to buying a home in Houston when interest rates are high. If you aren’t dialed into the Houston real estate market like we are here at Angel Fultz Realty, you might miss them. Here are the reasons why we recommend buying a house at the current interest rate and refinancing the mortgage later:

Advantage #1: Lower Housing Prices

The last couple of years, the housing market in Houston was insane. Too many buyers were competing for a historically low inventory of homes for sale. Multiple offers over asking price would come in the same day a desirable house hit the market, sparking constant bidding wars. Supply and demand were completely out of whack in the Houston market.

Related: How to Win a Bidding War to Buy a Home in Houston

Interestingly, higher interest rates reduce the number of buyers who qualify for a mortgage loan, thereby reducing the competition for homes. When competition goes down, HOME PRICES GO DOWN! It’s simple economics, and it happens EVERY TIME.

Advantage #2: More Inventory

While homes are still selling relatively quickly compared to before the pandemic, the Houston housing market is seeing homes stay on the market longer. With additional listings coming on market and longer “days on market” for current listings, inventory is increasing. And that’s a good thing for buyers.

Most of the home buyers we work with want to CHOOSE the house they will live in, not settle for the first house they can get their hands on. Growing inventory means that’s becoming possible again! When interest rates cool the market down, buyers benefit.

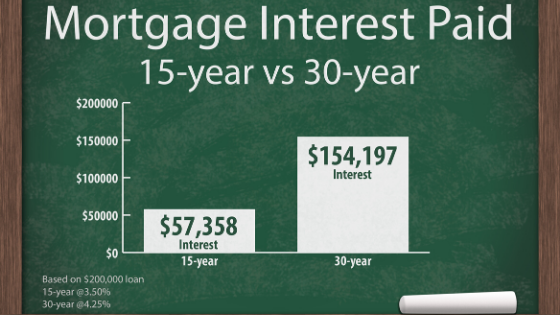

Advantage #3: You Will Pay Less Over the Lifetime of Your Loan

What goes up must come down. Interest rates are already down from their recent high, and they will continue to drop as the Houston economy recovers. When they do, you can simply refinance your loan. In fact, many loan companies are actually giving out lower rates NOW because they anticipate that you’ll refinance later anyway!

Related: Why is Rent So High in Houston?

When you’ve taken your pick of Houston houses at a lower price than you could two years ago and then pay a lower interest rate in a couple of years, that’s what we call a real estate WIN. You might discover you have neighbors who are paying far more for their houses because they bought at the top of the market.

Obviously, you should still only buy as much house as you can afford now. If you aren’t sure how much house you can afford, we can help! Contact us today for a free consultation on your Houston real estate needs. We love helping home buyers get a great deal on real estate in the Houston area!

This Post Has 0 Comments